The 20 Best Magento Agencies - Adobe Commerce (2024)

We've put together a list of the best agencies for Magento e-shops. All of them are Magento 2 experts!

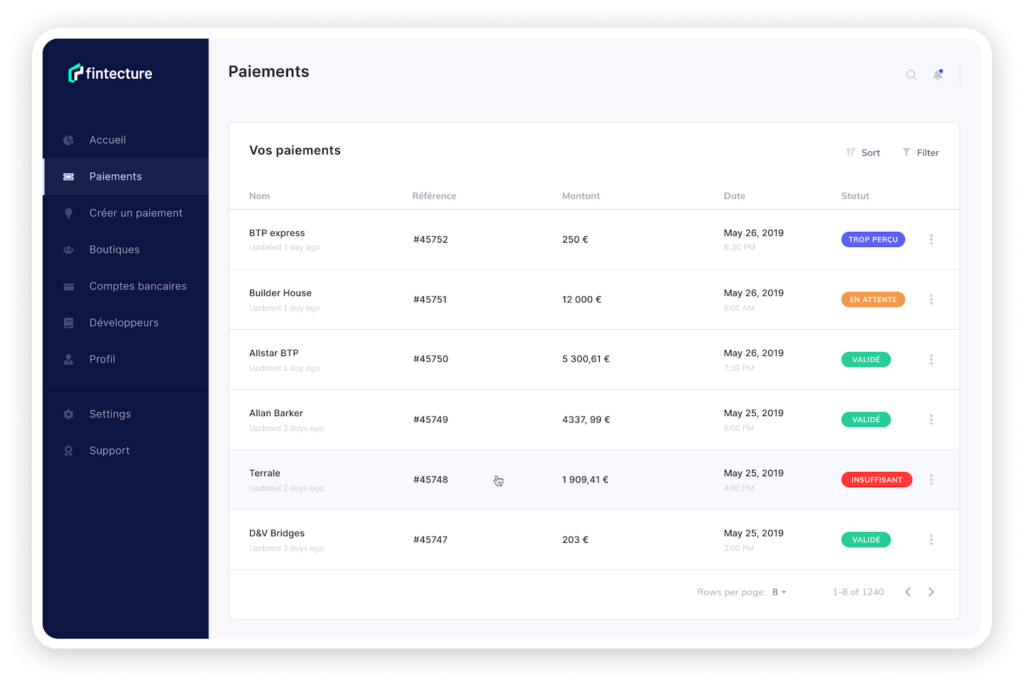

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

The DSO (Days Sales Outstanding) represents the average payment period of a company's debtors. The higher the DSO, the longer it takes for customers to pay their receivables, thus weakening the company's cash flow. Internationally in 2021, DSO has increased by more than 2 days to reach 68 days*!Optimizing DSO is undoubtedly a priority for companies and we will see how our global payment solutions can limit it.

For calculate its DSOa company must establish a relationship between its trade receivables and its sales. The formula is as follows:

Receivables including VAT for a period / sales including VAT for the same period x number of days in the period.

The higher the DSO, the higher the working capital requirement (WCR) increases, creating a cash flow risk.

Reducing the payment delays of its customers is not an easy task! However, different elements can easily be put in place by companies to the process of settling customer receivables and limit those at risk. and limit those at risk.

According to Forrester, most French companies have a DSO of 20 to 30 days. In an uncertain economic environment, where cash management is paramount, reducing DSO is becoming more than ever a priority for most companies.

The B2B payment solutions Fintecture's solutions offer different levers to efficiently manage your collections and be able to take the right actions:

We note on the average use of our solutions by our customers :

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

We've put together a list of the best agencies for Magento e-shops. All of them are Magento 2 experts!

Master this payment method to boost your transactions: how it works, its advantages, and the essential questions to ask.

The QR Code has multiplied in several forms, including the possibility of issuing a payment request. Practical and adaptable to different situations, it has quickly been adopted by many mobile payment applications.