Expand your B2B sales with Buy Now Pay Later

Easily grant payment terms to your business customers, with the assurance of being covered in the event of non-payment.

In partnership with

800,000 payers

already use our transfer solutions

On-board credit insurance in

a smooth payment path

Automate your receivables management

Your business customer's identity and eligibility are verified in seconds.

Payment on time is instantly guaranteed.

Collection of payment on due date

We collect the funds from your customer.

You're informed in real time, without having to do a thing!

Automated and amicable management of disputes

We take care of all reminders, and in the event of a proven non-payment, we automatically forward the file to Allianz Trade for collection and compensation, at no extra cost.

Unleash your sales with BNPL

Increase your average baskets

by offering payment facilities to your business customers

Don't miss a sale

by refusing an extension payment

Retain

your customers with more flexible payment terms and no fees

Be serene

by offering payment at maturity with the certainty of payment

Automate

the complete management of your outstanding receivables

Secure

your cash flow

A solution for all your

sales channels

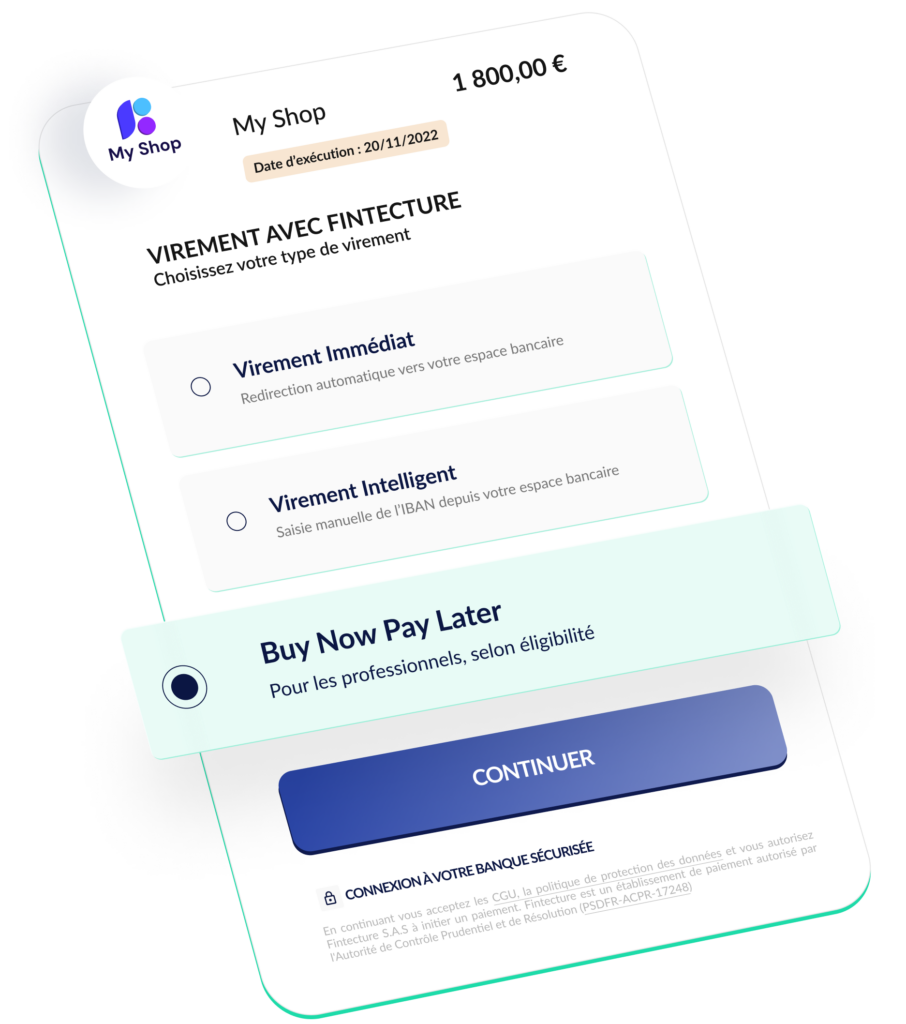

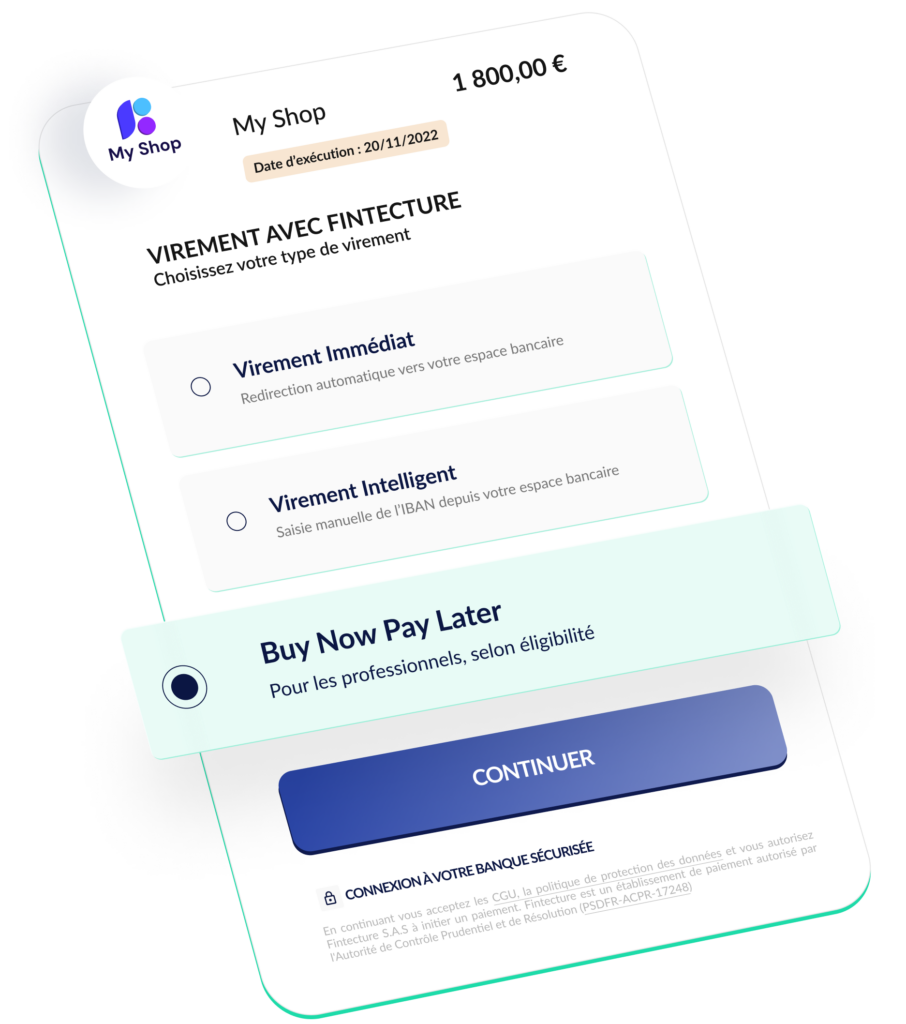

E-commerce

By offering BNPL directly to eligible payers on your check-out.

In store

Offer your customers on-the-spot payment by due date.

Remote

Simplify the collection of your quotes and invoices by integrating payment links.

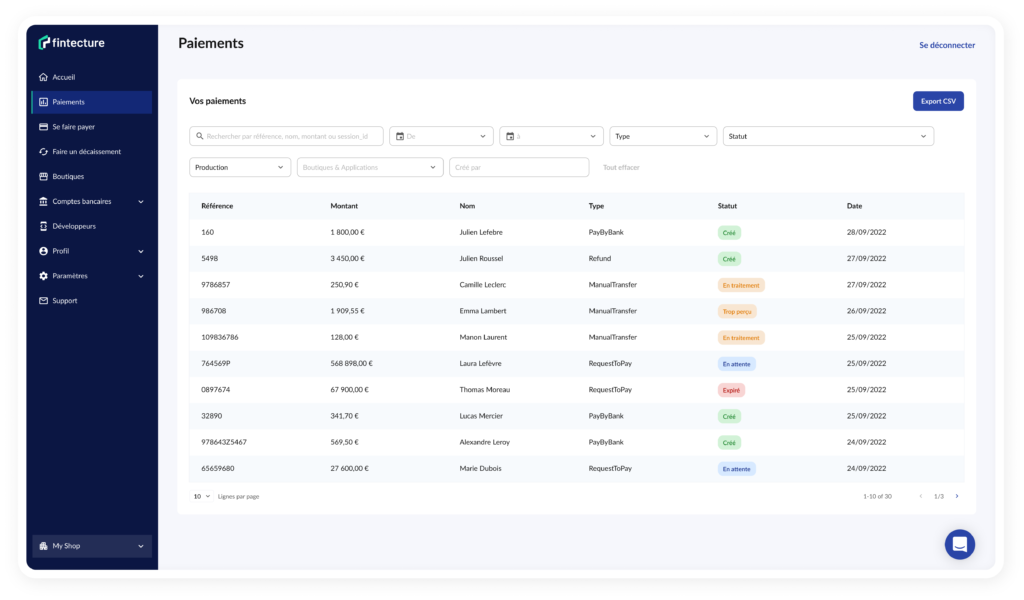

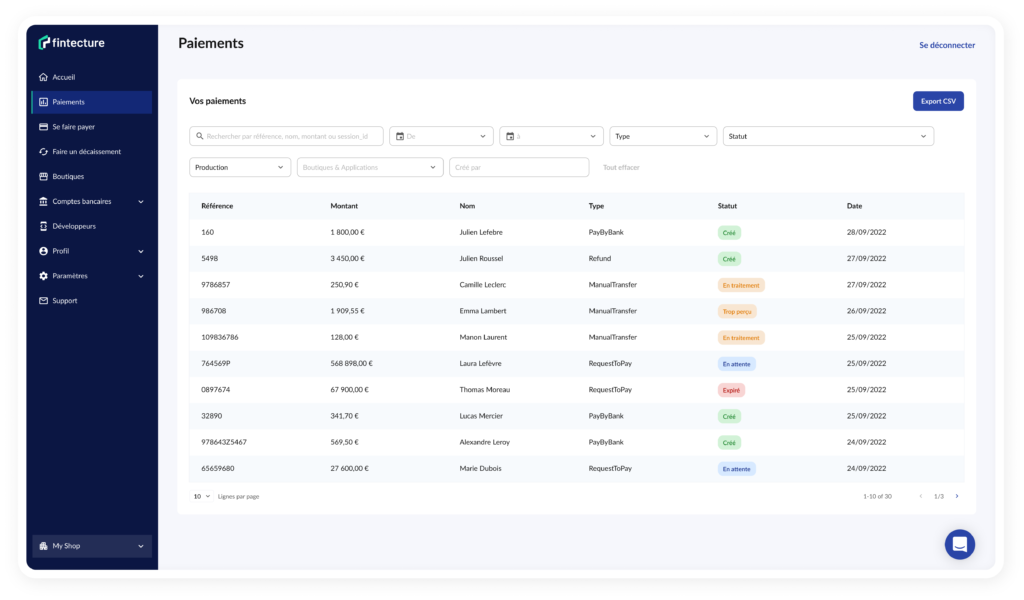

Control interface

Track incoming payments in real time and get paid quickly

Find out how our customers

use our Buy Now Pay Later service.

#B2B #B2C #Bricolage

Domomat generates +16% new trade customers thanks to Fintecture solutions

Optimize your company's payment efficiency

Use Fintecture to optimize your collection process, increase payment acceptance, prevent fraud and grow your business.

Twice a month, take part in our product webinars to find out more about our payment solutions. You can also contact our teams directly for integration advice to see the added value of Fintecture more quickly.