How to reduce your DSO with payment solutions?

DSO (Days Sales Outstanding) indicates the average time taken to pay customers. A high DSO lengthens the settlement time, impacting the company's cash flow.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Over the last ten years, the QR Code has become a common and even everyday gesture, and has multiplied in many forms, including the possibility of issuing a Payment Request. Practical and adaptable to different situations, it has quickly been adopted by many mobile payment applications.

In these times of Covid, when direct contact is discouraged and gestures from a distance are de rigueur, the transfer of money is no exception to the rule.

Contactless payment methods, also known as Near-Field Communication (NFC), are the best alternatives to cash or credit card insertion.

The contactless payment offered by banks has been around for several years and is already very popular in France, with more than 4.6 billion uses in 2020, and has continued to grow since its introduction.

Still with the aim of making payments easier for users, it is also possible to make purchases with your smartphone by integrating your bank card. This other NFC payment solution, such as Apple Pay and Google Pay among others, makes it possible to pay with your smartphone without even taking your card out or carrying it with you.

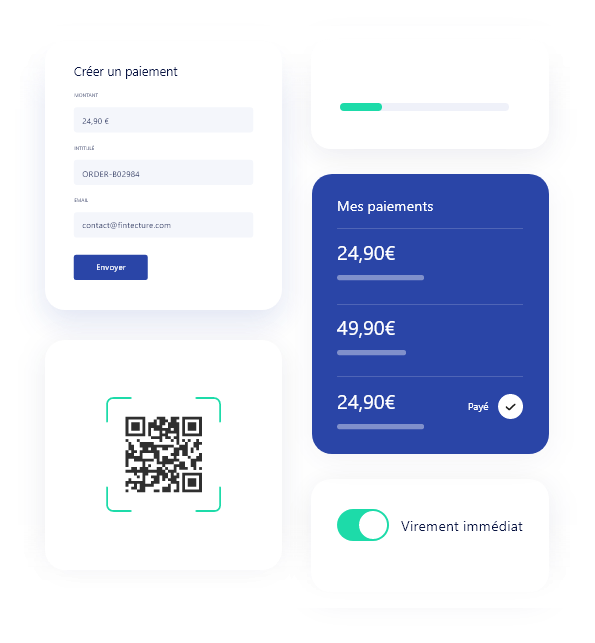

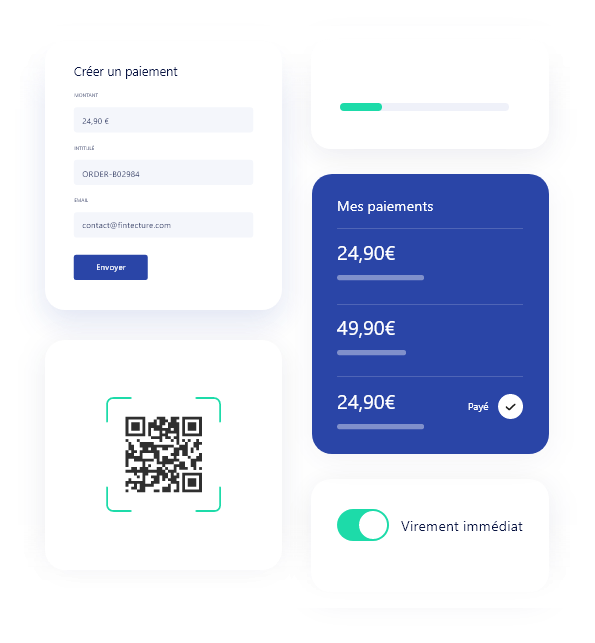

QR Code payment , the latest contactless payment method to be popularized by the health pass , is proving to be the most versatile means of payment. It simply generates a code to be scanned in person or sent to the customer. This technology also enables any company, SME or large group, to create a Rapid Payment Request without necessarily having a payment terminal.

In fact, a craftsman, an architect or even a store wishing to charge directly on the shelves, in order to reduce waiting times at the checkout, is able, thanks to the Fintectureis able to provide a link for scanning.

The merchant will simply have to fill in the amount and the reference of the order, then choose whether he wants to show the code in person or share the request by sending it to his customer. After scanning the QR code, the customer will be redirected to his bank interface where he will simply be asked to log in and validate the transaction. No bank data transfer between the two parties, no need for a special application for the scanner! The merchant will instantly receive a payment confirmation and can continue his activities without any worries, as the payment is irrevocable (it cannot be cancelled on the customer's side).

Denso-Wave is the Japanese company that developed the Quick Response Code in 1994. It was initially a tool for tracking spare parts in Toyota factories. More powerful than the barcode, it can contain 300 times more information.

It was in 2002 that it went beyond use in the automotive industry to be more widely used by the Japanese. This is probably one of the reasons why the QR Code is much more present in Asia. China, in particular, has a high usage of the technology as a payment or commerce tool, mostly from companies like Alipay. Juniper Research estimates that these payment volumes will triple in the next five years globally.

Since its introduction in France, the flashcode, as it was called, has fulfilled the basic function for which it was created, i.e. obtaining information about a good or a service. But little by little, services such as Lime were offered the code to charge for their services, in this case the rental of scooters.

Since its introduction in France, the flashcode, as it was called, has fulfilled the basic function for which it was created, i.e. obtaining information about a good or a service. But little by little, services such as Lime were offered the code to charge for their services, in this case the rental of scooters.

In addition to the effects of the crisis as with the health pass, some restaurants have also already introduced technology to make it easier and more secure to pay for orders. Bars now offer to charge after choosing a drink, and bring it directly to the table after reading the code.

Finally, one of the challenges of democratizing Quick Response is to ensure greater protection of privacy during transactions. One of the main benefits is to reduce the number of intermediaries between the payer and the receiver. By integrating its Payment Application solution into its ecosystem, Fintecture is exactly in line with the banking data security approach mentioned earlier. Moreover, the absence of intermediaries between the company and the customer also avoids any technical friction during payment, and above all considerably reduces transaction costs.

Considered as fast and simple, the flashcode is also a means of securing the order. As in the example of the restaurant owner, the latter is effectively certain to receive his payment when ordering and thus avoids "restau-basket". The reconciliation of transactions will also greatly facilitate the work of the accountant since each payment is clearly identifiable. Furthermore, by using Fintecture as an option, the payment is even irrevocable and the status of the request is visible in real time.

Another benefit of the QR Code is the problems of paying for an order with cash. The new generation in particular tends not to carry cash around with them. If a merchant does not take a card below a certain amount, the customer is stuck. Generating a very low-cost code in a few seconds, which can be presented directly to the merchant, is a way to secure the order. It is also a way to make dematerialised tips.

In addition, where most companies require an application for both parties, Fintecture allows a payment link directly scannable by the customer like any other code.

Strong authentication secures purchases. By logging in and validating the transaction from their banking interface, the parties protect themselves against possible accusations of fraud. Finally, it is not necessary to have a website to collect payments, so the solution is suitable for everyone.

In these three case studies, discover different examples of the application of the Fintecture Payment Application and how it solved these companies' payment problems.

Flexibility, speed, ceiling bypassing, in B2B or B2C, the solution adapts to all payment situations since it also offers links or emails to be generated on the same principle.

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

DSO (Days Sales Outstanding) indicates the average time taken to pay customers. A high DSO lengthens the settlement time, impacting the company's cash flow.

Find out how Fintecture fights money transfer fraud. Risks, consequences and solutions to secure your transactions.

Find out how Fintecture's payment by transfer optimizes donation collection. Simplify the process, increase conversions.