Aon joins forces with Fintecture to support its customers' digital transformation with innovative B2B payment solutions

AON x Fintecture partnership: working together to help companies secure their collections and protect their receivables.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Payment initiation is a new and fast-growing payment method. But how does this new service work? And how does it compare with traditional payment solutions?

In this guide, we explore the world of payment initiation, deciphering how it works and highlighting its benefits.

Payment initiation is a key concept in the modern financial landscape. It enables a company toinitiate credit transfer payments in a simple and secure way. In other words, it's a mechanism that authorizes a merchant to ask a buyer to make a payment by bank transfer. This method is revolutionizing online payments in France and Europe, offering a real alternative to card payments and traditional bank transfers.

To fully understand payment initiation, it's essential to grasp its importance in today's context. It simplifies the payment process by eliminating the constraints associated with traditional card and credit transfer payments, thereby improving the efficiency and security of transactions. Consumers benefit from a smoother smoother purchasing process, while merchants benefit from the leverage they need toincrease sales and simplify the operational processing of cash receipts.

The Payment Services Directive 2 (PSD2) was the catalyst for payment initiation in France. It paved the way forOpen Bankingwhich enabled payment service providers to interact directly with banks. This directive has strengthened transaction security and encouraged innovation in the payments sector.

L'Open Banking is a major trend that has revolutionized the financial sector. It is based on the opening up of banks' information systems and the sharing of customer data with third parties, such as payment service providers. Thanks to Open Banking, payment service providers such as Fintecture can connect directly to banks to initiate SEPA credit transfer payments. This has paved the way for payment initiation as we know it today.

To fully understand how payment initiation works, let's look at the process in detail. It all starts with the merchant, who creates a transfer order indicating the transaction amount and order reference. This step is crucial, as it's where the payment is initiated. The merchant can carry out this step via a dedicated system or a payment platform such as Fintecture.

Key point: only regulated regulated players are authorized to orchestrate account-to-account payments. This is the case for Fintecture, which holds various approvals, including a license to operate payment initiation services (PIS).

Once the transfer order has been created, payment service providers (PSPs) or payment initiation service providers (PISPs) come into play. They contact the buyer's bank to initiate the payment. This interaction between the PSP/PISP and the buyer's bank is made possible byOpen Bankingwhich enables payment service providers to connect to banks' information systems.

The buyer also plays an essential role in the process. When payment is initiated, the buyer must validate the transaction. Payment cannot be made without the buyer's agreement. This validation is based onstrong authentication, which guarantees payment security.

To better understand how payment initiation works, let's take a look at the different steps involved in a Fintecture payment.

A key element to understand is that payment initiation can take place via two types of SEPA credit transfers: the standard credit transfer and the instant transfer. The standard credit transfer follows traditional payment protocols and can take some time to process, typically one to three business days. In contrast, the the instant transfer is a faster optionallowing almost immediate transfers.

It is the payment initiation service provider who directs the transfer to the best possible option. Some PISPs only offer instant transfers, excluding banks that do not offer this option free of charge. At Fintecture, we prefer instant transfers if the option is available and free for the customer. Otherwise, the transfer is carried out as a standard transfer. Important point: whatever the option chosen, we send the merchant an immediate immediate payment confirmation.

For businesses, payment initiation offers several key advantages.

For businesses, payment initiation offers several key advantages. It increases the purchase basket, giving customers the opportunity to make larger purchases. Unlike card payments, which are often limited to a few hundred or thousands of euros, payment initiation by credit transfer enables you toamounts up to 30 times higher. This flexibility is a major advantage for companies looking to increase their sales.

At Fintecture, we find that the average basket is 3 times higher than the average bankcard basket.

Another key advantage of payment initiation: the reconciliation between payment and order is automated. It is now possible to collect payments by bank transfer without having to manually punch in each transaction. With payment solutions such as Fintecture, the order corresponding to the payment is automatically identified in real time.

This time-saving not only reduces the workload of our accounting teams, but also enables us to process orders more quickly. This responsiveness is essential to guarantee rapid delivery (essential in many sectors), and to process large volumes of orders. of orders.

Unlike a conventional bank transfer, where the customer has to set up the payment manually, payment initiation enables a seamless payment experience. seamless payment experience. This new payment method is particularly well suited to e-tailers who want to improve their conversion rate. It offers all the advantages of payment by bank transfer, without the drawbacks. Customers no longer need to leave the site to register a new beneficiary or set up a transfer.

Another crucial point for merchants is that payment initiation makes it possible to recuperate the failures of other payment methods. It is an effective alternative for converting refused payments for customers who have reached their bankcard limit.

Payment initiation by bank transfer also offers numerous advantages for consumers, simplifying the purchasing process and enhancing their overall experience.

For buyers, payment initiation makes paying by bank transfer as easy as paying by credit card. It is no longer necessary to register the beneficiary of the transfer with his bank, nor to set up the transfer manually. All the information required for payment is pre-entered Unlike a conventional credit transfer, there's no complex information to enter, which reduces the risk of errors!

Unlike traditional credit transfers, merchants process payments made by payment initiation more quickly. instant payment confirmation (as with a credit card payment), enabling the order to be processed immediately. Conventional processing times are eliminated, and the customer receives his or her purchase more quickly.

Security is a priority for all online shoppers. The initiation of payment by bank transfer reinforces this security by using strong authentication to validate the transfer. This ensures that only authorized persons make payments. What's more, the payment institutions orchestrating the transactions deploy powerful devices to detect the risk of fraud.

Last but not least, payment initiation by bank transfer offers a totally paperless purchase path, ideal for mobile devices. Whether you're using a smartphone or a tablet, you can make payments quickly and securely, wherever you are. No need to take out your bank card when you're on the move, payment is made directly onlinesimple and secure.

What's more, the "App to app" functionality allows you to switch directly to the banking application of most banks, making it even easier to identify the payer.

Initiating payment by credit transfer is a relatively recent innovation, but its impact is already significant. As merchants and consumers begin to adopt this payment method, it's essential to consider its future in France and Europe.

Payment initiation has gained in popularity among merchants in France. More and more companies are seeing the benefits it offers, from increased shopping baskets to enhanced payment security. This growing adoption translates into an improved shopping experience for consumers, who benefit from a smoother, more secure payment process.

At Fintecture, we are seeing exponential growth in payments made by Immediate Transfer. By the end of 2023, over 800,000 payers had already used Fintecture's money transfer solutions, 40% of them several times.

Payment initiation has seen growing adoption in the French retail sector, and this trend is only set to continue. More and more merchants and e-tailers are opting for this payment method to meet their customers' needs. This means that consumers now have more choice and flexibility when it comes to paying for their purchases, greatly enhancing their shopping experience.

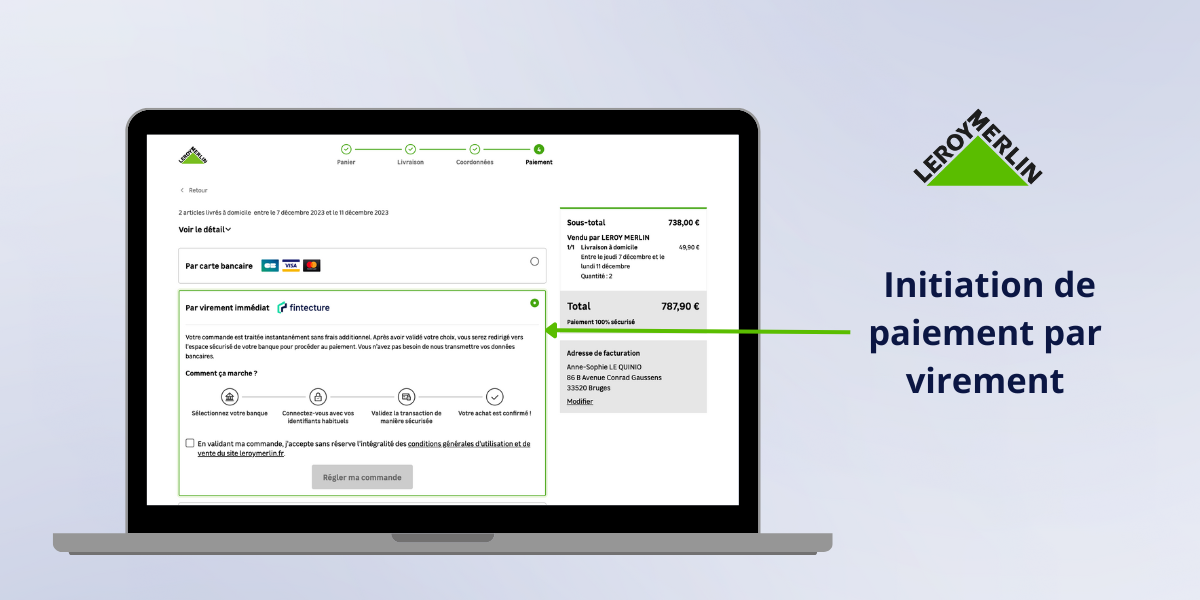

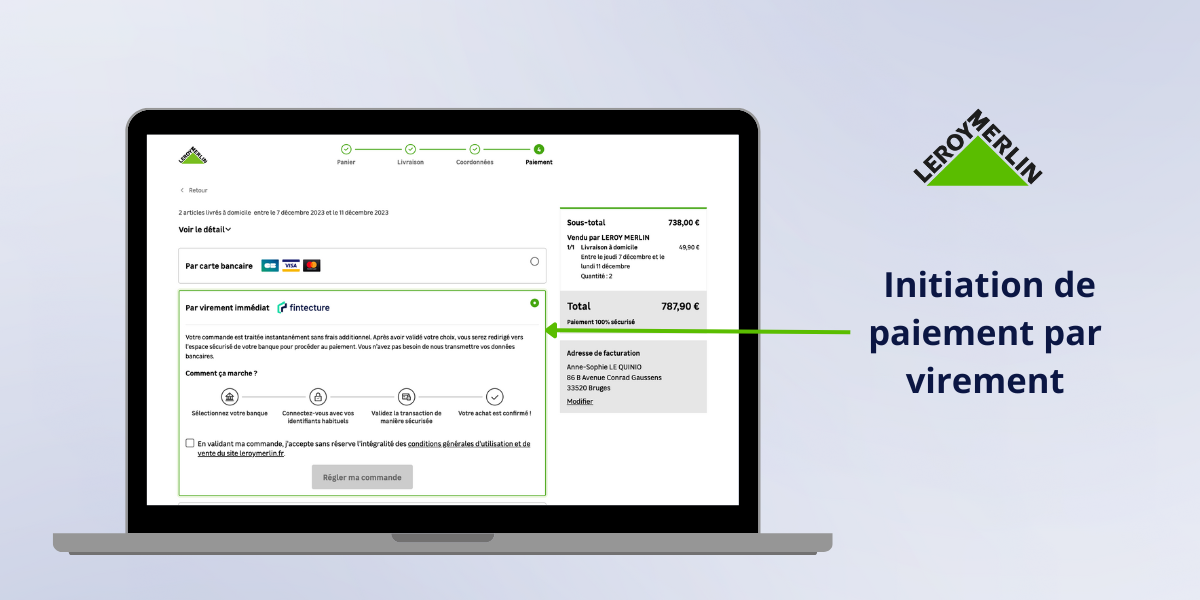

Proof of the development of payment initiation, many references offer the Fintecture Immediate Transfer: Leroy Merlin, Bobochic, Aramisauto...

The BtoB market is characterized by high average shopping baskets, which are often difficult to collect by credit card. As a result, 90% of inter-company payments are made by bank transfer. Against this backdrop, payment initiation is revolutionizing traditional payment methods by enabling smoother, faster and more secure BtoB payments.

Numerous BtoB references have already adopted Fintecture Immediate Transfer: Edenred, Raja, Bricoman, AS24 (TotalEnergies), La Redoute Business...

Payment initiation is becoming increasingly popular with associations and NGOs. It supports the development of online donations. Payment initiation overcomes the constraints of card ceilings, which restrict the high levels of donations that are essential to the operation of associations. Thanks to a faster transfer payment process, associations secure donations from major donors.

For example, iRaiser (a specialist in online fundraising) has integrated the initiation of payment by bank transfer into its donation platform. Restos du cœur, UNICEF and many other associations improve their online collections with Fintecture's Immediate Transfer.

In conclusion, payment initiation by credit transfer is an important innovation in the field of online payments in France. It offers significant benefits to businesses, individuals and the economy as a whole. This method simplifies the payment processincreases transaction security, and offers greater flexibility in terms of payment amounts.

Its growing adoption in France and Europe bears witness to its success and potential. The future of payment initiation is bright, and we can expect to see this method revolutionize the way we make online payments.

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

AON x Fintecture partnership: working together to help companies secure their collections and protect their receivables.

One third of the companies that have been victims of fraud have suffered losses of more than 10,000 euros and 14% more than 100,000 euros. Fraud is thus a major issue for the financial stability of companies.

This €26 million Series A round brings Fintecture's funding to a total of €32 million, following a €6 million round raised in May 2021.