Instant money transfer explained: Speed, rates and advantages

Discover instant money transfer in France: fast, secure payments. Complete guide to rates and compatible banks.

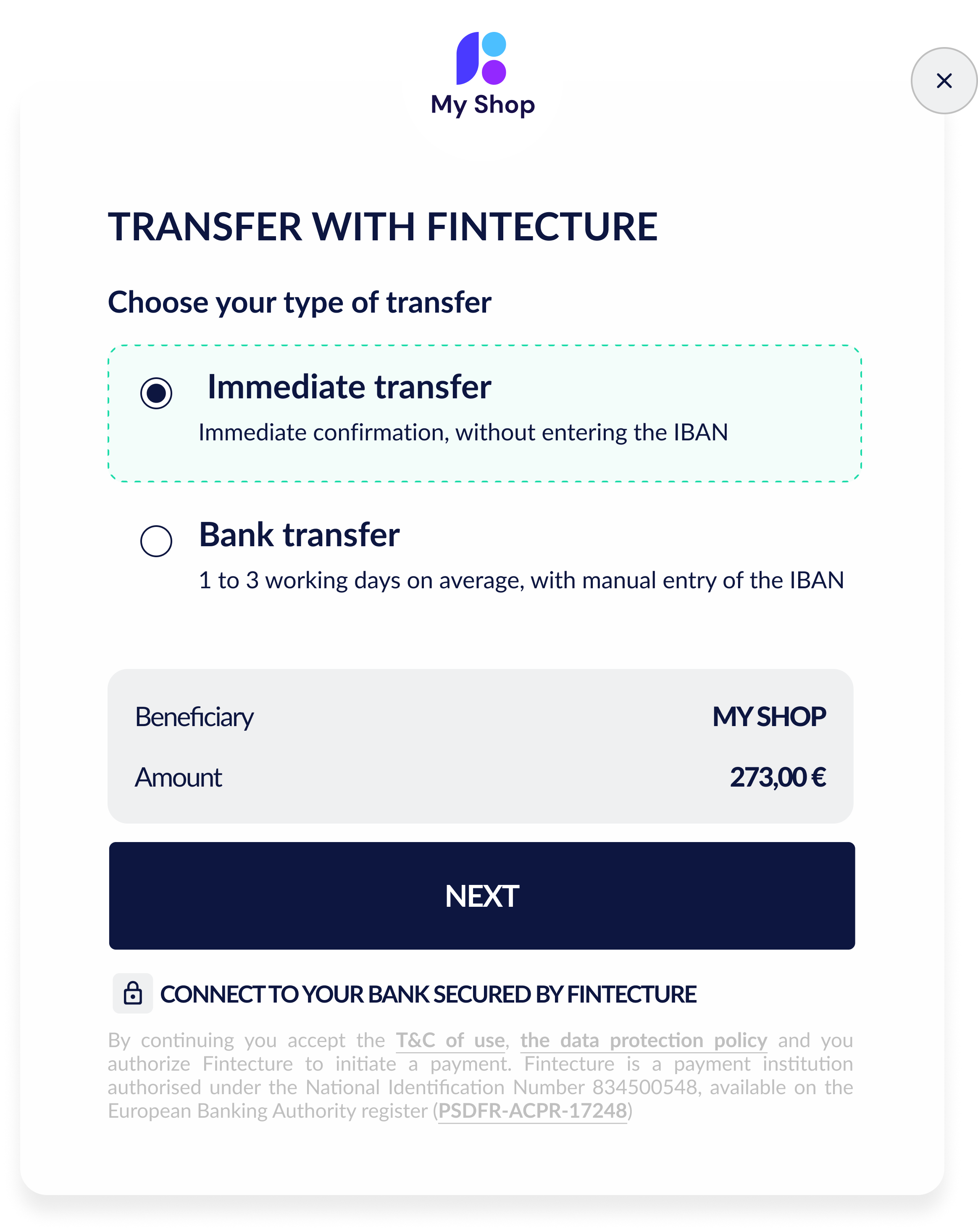

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Lhe Euler Hermes DFCG 2021 Fraud and Cybercrime Barometer* reveals that 2 out of 3 companies have suffered at least one fraud attempt last year. Worse, 1 in 5 suffered more than 5 attacks! One third of the companies that were victims of fraud suffered losses of more than €10,000 and 14% more than €100,000. Fraud is therefore a major issue for the financial stability of companies, and in some cases for their survival. In a B2B context, they face different types of fraud. Fortunately, solutions exist to fight against this scourge, which mainly affects bank cards and checks, and much less so bank transfers.

Fake vendor fraud is a very common practice in cybercrime. 46% of respondents to the barometer Euler Hermes DFCG 2021 report this scam, which consists of which consists of pretending to be a company's supplier in order to obtain payment of invoices.

This type of scam has become more and more common in recent years with a wide variety of companies, which suffer losses that can amount to several million euros. The fraudster contacts the accounting department pretending to be a client. After a few exchanges, the fraudster asks for an urgent and confidential international transfer.

A fake customer impersonates a customer or supplier and then misappropriates a company's funds or goods by reporting a change of address, bank details, or by demanding the return of funds paid after signing an estimate.

In this type of fraud, an accountant or CEO of a company is contacted by a fake bank advisor. The latter then asks them for banking information necessary to validate a supposed transaction in order to carry out fraudulent debits.

Ransomware attacks are becoming increasingly common. This technique consists of sending a malicious software to the victim that encrypts all his data and then asks for a ransom in exchange for the decryption password.

A malicious third party can also usurp the identity of a company or a website by creating a site identical to the real one. The goal: to make you place an order by making you believe that it is the authentic site, but after payment you will never receive the order.

The second European Payment Services Directive (PSD2) of 2018 gave legal existence to the activities of fintechs and a regulatory framework for their activities. The latter have been able, with a high level of transaction security :

Strong authentication rules have been created and imposed by banks in order to secure transactions, especially remote ones.

L'strong authentication of the payer consists in verifying the legitimacy of a transaction by checking the presence of two elements only known by the payer:

In general, to secure your transactions, knowledge of the payer's profile is very useful. It is also important to make your customers aware of the risks linked to fraud, to equip yourself with customer scoring tools that allow you to measure the risk of non-payment according to the profiles, to scrupulously respect the regulations in force, to follow the news linked to fraud in order to better adapt to the new techniques and finally, to be accompanied by a true payment professional... that is where we come in.

It is essential to choose a payment institution approved by the regulator. Fintecture is one of these establishments and has the ACPR-17248 information access and payment initiation licenses, as well as new payment transaction execution and payment order acquisition accreditations that allow us to receive money from merchants in an account in our name and to make transfers for them from there.

Fintecture also owns its payment infrastructure and dedicated algorithms in order to optimize the security of our customers' and users' transactions. We also expose the security issues of the fintech ecosystem to the regulator in order to strengthen the inherent regulatory framework. Fanny Rodriguez, Secretary General and COO at Fintecture, is participating in a working group on security and represents fintechs on the key issue of fraud.

Finally, our action focuses on the detailed knowledge of payers and merchants through various key criteria and we are also in close contact with the various regulatory bodies to report transactions identified as suspicious.

Before choosing your B2B payment solutions payment solutions, we recommend that you consider the following points:

*Euler Hermes barometer

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

Discover instant money transfer in France: fast, secure payments. Complete guide to rates and compatible banks.

One third of the companies that have been victims of fraud have suffered losses of more than 10,000 euros and 14% more than 100,000 euros. Fraud is thus a major issue for the financial stability of companies.

Explore the future of payments with Verifone and Fintecture. Innovative bank transfer solutions await you. #partnership