Instant money transfer explained: Speed, rates and advantages

Discover instant money transfer in France: fast, secure payments. Complete guide to rates and compatible banks.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Although bank transfers are one of the most secure means of payment, they are not immune to attack by fraudsters. Unfortunately, hackers are always one step ahead, and no company is immune. Admittedly, the number of credit transfer frauds remains relatively low compared to other payment methods. But the consequences for your profitability and image are far-reaching: the customer experience is degraded and your relationship is weakened.

Fortunately, there are solutions to protect your sales and preserve your customer relationships. All the answers in this article!

According to the annual report of the Observatoire de la sécurité des moyens de paiement (OSMP), credit transfer fraud tripled between 2017 and 2022, from 78 to 313 million euros. Let's take a closer look at the three types of fraud that directly affect retailers.

As a merchant, you too can become a direct victim of fraud. Too many companies still display the IBAN of their bank account directly on their website. If your site isn't secure enough, hackers can modify the code to display their IBAN instead of yours. This makes it easy for them to collect payments.

Another undesirable effect: fraudsters can use your IBAN to make purchases particularly via direct debit mandates. More often than not, they do this for small amounts, so as not to attract your attention. But when all is said and done, these sums can be substantial, and represent a serious loss to your cash flow. So be careful not to circulate your RIB by e-mail, post or on your website!

Don't forget that bank details are sensitive sensitive personal data that you need to protect, both as an individual and as a professional.

Advisor fraud

The fraudster makes purchases using a customer's bank account, manipulating them into validating the payment. The most common method is bank advisor fraud (social engineering), in which the fraudster poses as the victim's bank advisor.he fraudster poses as the victim's bank advisor. He pretends to have spotted suspicious transactions and encourages the victim to validate the cancellation of these transactions. In reality, the victim validates a strong authentication for a fraudulent payment. Advisor fraud accounts for 53% of all embezzled money transfers.

When the victim realizes this, he or she turns to his or her bank, which will contact yours to request a refund. This process is called "Recall request".

As a merchant, you're under the impression that you've paid for your order, and in many cases you've already dispatched the goods. You're not obliged to respond to a recall request (since the transfer is irrevocable once made). But these incidents tarnish your reputation and remain complex for your teams to manage.

Mailbox hacking

In this case, the hackers break into your customer's mailbox. They access his e-mails and see that a transaction is in progress with your company (quotation, invoice). The fraudster will then usurp your identity and send an e-mail to the customer, in which he will use your corporate identity and elements reminding him of the context of the purchase (date of purchase, product purchased...). The fraudster will then pretend to have changed his bank details and send your customer a new IBAN (his own).

He then transfers the money to an account that isn't yours. He thinks he's paid you, but you never receive the funds. This tricky situation can lead to cancellation of the order, or worse, to non-payment.

So how do you collect bank transfer payments while protecting your customers and your company?

Fintecture is a French payment institution specializing in credit transfers. Strongly committed to the fight against fraud, we share with you concrete advice on how to secure your credit transfer collections.

With Fintecture, you can receive payments by bank transfer without disclosing your IBAN. There are 2 ways to do this:

Immediate transfer :

The Immediate Transfer is an initiation of payment by bank transfer. Thanks to Open Banking, your customer pays you by transfer without needing your IBAN. All the information required for payment is "embedded" by Fintecture: your IBAN, the payment amount and the order reference. For your customer, the experience is just like paying by credit card. For your part, you benefit from all the advantages of a bank transfer, with immediate payment confirmation.

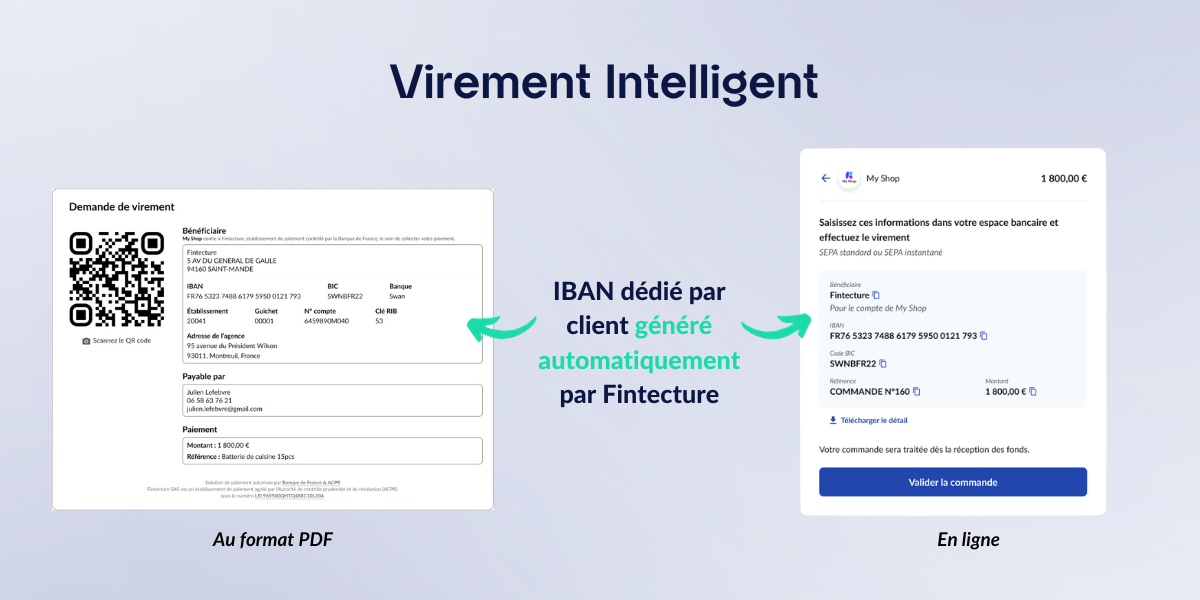

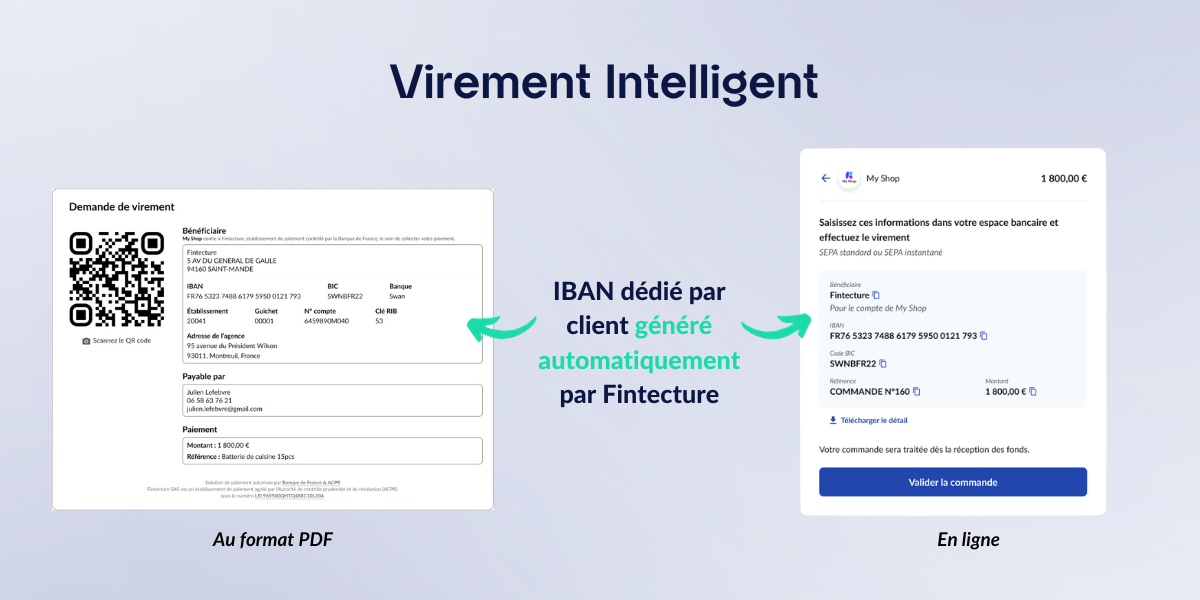

Smart Transfer :

The Smart Transfer is a conventional bank transfer reconciled automatically. Unlike the Immediate Transfer, your customer must register an IBAN and set up the transfer manually. But you don't need to communicate the IBAN of your company's bank account. Fintecture generates a personalized IBAN for each customer. Payments are collected on a Fintecture payment account and then disbursed to your main bank account.

These two payment methods complement each other. To maximize your conversion, we recommend that you activate both options.

We recommend that you ask your service providers about their anti-fraud policy. Don't hesitate to challenge them on this point, as fraud should not be a taboo subject. Aware of the risks involved, Fintecture is actively engaged in the fight against fraud. As a result, all our solutions incorporate a powerful anti-fraud device to identify high-risk payments:

Transaction Monitoring System (for all merchants) :

The TMS analyzes all Fintecture flows in real time to identify suspicious payments. This "screening" relies on a powerful algorithm that cross-references over 60 business rules, based on data linked to identity theft, payer behavior and fingerprinting. A dedicated team completes the analysis of suspicious cases, and contacts the merchants concerned if necessary.

Premium Fraud Shield (on-demand option) :

Complementary to TMS, the PFS is a unique device on the market for proactively blocking high-risk payments. Parameters are set in collaboration with the merchant to find the right balance between conversion and risk management.

In short, it's essential to protect yourself from the risk of fraud. Solutions exist to enable you to collect transfers in complete security. Thanks to Fintecture solutions, you can secure your cash flow and preserve your customer relationships. Whatever your distribution channel (e-commerce, point of sale, remote) or customer profile!

To find out more about our solutions and discuss your issues, contact our Payment Experts.

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

Discover instant money transfer in France: fast, secure payments. Complete guide to rates and compatible banks.

Free and convenient for customers, efficient and opportunity-generating for merchants, click & collect has it all!

This €26 million Series A round brings Fintecture's funding to a total of €32 million, following a €6 million round raised in May 2021.