CUSTOMER CASE

"We saw an immediate impact on our sales with +16% new business customers, just a few months after the launch."

ACTIVITY

B2B

B2C

DIY

USE FINTECTURE

- - Immediate transfer

- - Smart Transfer

- - Buy Now Pay Later

Result

- +16% new customers in just a few months

- +17% transfers

Interview with Jean Dumetz

E-commerce Manager at DOMOMAT

Domomat is based near Annecy and was founded in 2013 by Dominique Muller, an electrician by profession. Originally positioned for online sales of electrical equipment, the platform has extended its range to include DIY, and caters for both private individuals and building professionals. Domomat has sales of €15 million and over 35 employees.

Why did you choose to integrate Fintecture solutions on the Domomat site?

Initially, our payment methods were limited to credit card, PayPal and conventional bank transfer. However, we found that credit cards were unsuitable for large baskets, due to their ceilings, and bank transfers entailed delays that could compromise the speed of delivery crucial to satisfying our professional customers, who themselves have tight deadlines on certain sites. What's more, in the B2B sector, our customers are used to obtaining payment terms: we granted them very selectively and manually, limited to certain well-known customers. In the end, these situations exposed us to the risk of losing significant sales and seeing certain customers leave for the competition.

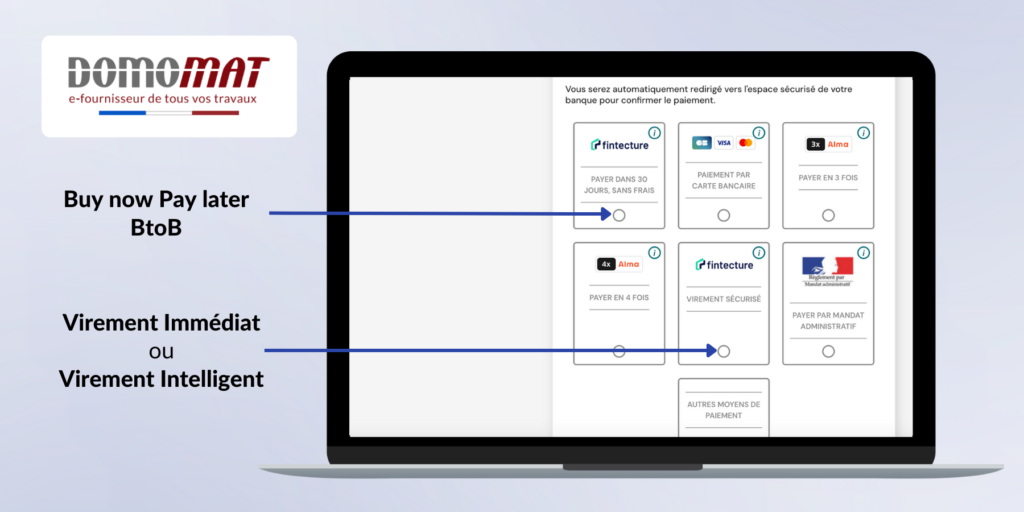

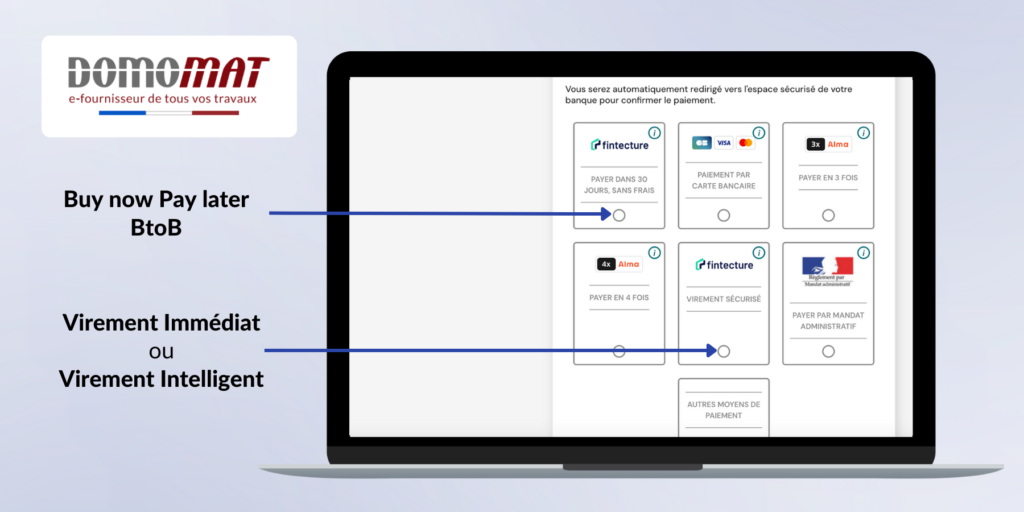

That's why we've chosen to integrate transfer solutions Fintecture credit transfer solutions to optimize our collection process: they facilitate the conversion of high baskets, without interrupting the checkout process, provide immediate payment status, and automate reconciliation, enabling us to be much more responsive! The difference was also made by offering Buy now Pay Later B2B offer, because our aim was to be one of the first sites in our sector to offer a deferred payment solution to meet the demand and consumer habits of our business customers.

What is your feedback on this Buy Now Pay Later solution?

Fintecture's Buy Now Pay Later enables us to offer payment facilities to all our business customers. They can obtain a 30-day credit at the time of their online purchases, in a matter of seconds and independently. It's a time-saver for everyone!

This enables us to offer greater flexibility, without the need for manual intervention by our teams, while at the same time securing the company's cash flow, since Fintecture not only checks eligibility in real time, but also collects payment on the due date; in all cases, we can be sure of being paid at the end of the payment period. In a way, we're delegating the management of outstandings and potential disputes. Above all, we have seen an immediate impact on our sales, with +16% business customers in just a few months.

You have deployed Immediate Transfer (without IBAN entry), Intelligent Transfer and Buy Now Pay Later. What results have you achieved?

Combining Fintecture payment solutions means we can address all our customers (individuals, small professionals or large companies), on any type of purchase, whatever the amount or terms (cash / due). This means we can maximize our conversion rate on every sale and build customer loyalty. In fact, half of our business with Fintecture comes from regular customers who appreciate this new payment method.

Our transfer volumes have risen by +17% in a short space of time, which clearly shows that there was a real need, and this in turn translates into an increase in our sales.

How have you supported the rollout of these new payment methods?

Integration was rapid, thanks to the Prestashop plug-in and the support of Fintecture's customer support teams for configuration and initial testing. Right from the launch, we actively communicated with our customers, with banners on our site, targeted emails, and a dedicated page to explain the different payment options and provide reassurance. We used the marketing kit provided by Fintecture, customizing it as we went along. In fact, after the launch, we continue to remind them regularly that they have access to these payment options. This support enables us to ensure that they adopt them and, above all, really reap the expected benefits.

USE CASE

Find out how our customers use

our e-commerce solution

"Instagrume reduces delivery times and facilitates rent collection with the help of the payment request".

"Testing the Fintecture payment was very simple and effective. I was convinced to offer it to my customers"

"GreenMotorShop uses the Fintecture payment application for its in-store and remote sales".

Already more than 7000 merchants trust us

3200,00 €

- Payment received!

READY TO CHANGE THE SYSTEM?

1799,99 €

- Payment received!

The future of payment is here:

join the movement!

249,99 €

- Payment received!