Aon joins forces with Fintecture to support its customers' digital transformation with innovative B2B payment solutions

AON x Fintecture partnership: working together to help companies secure their collections and protect their receivables.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

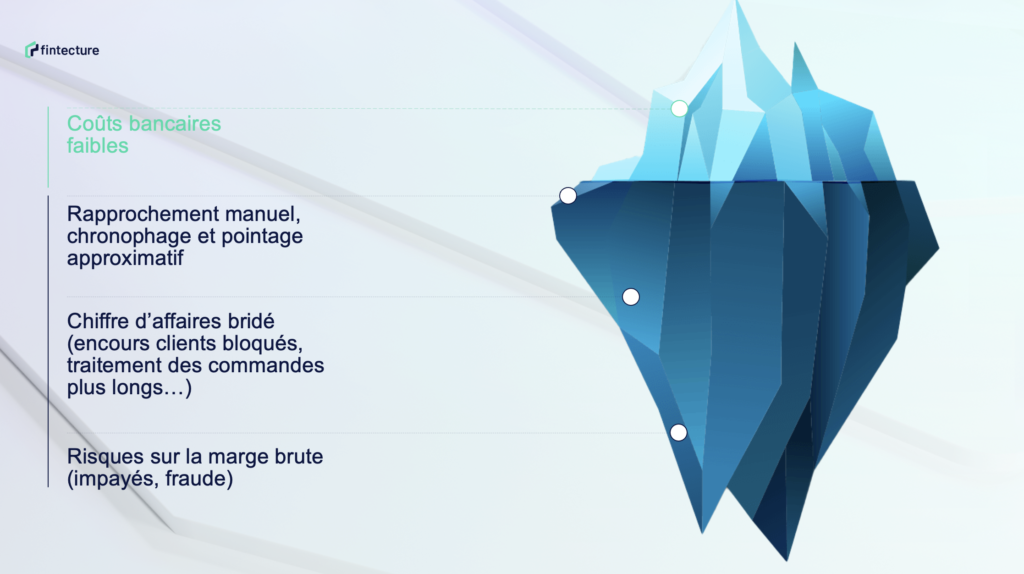

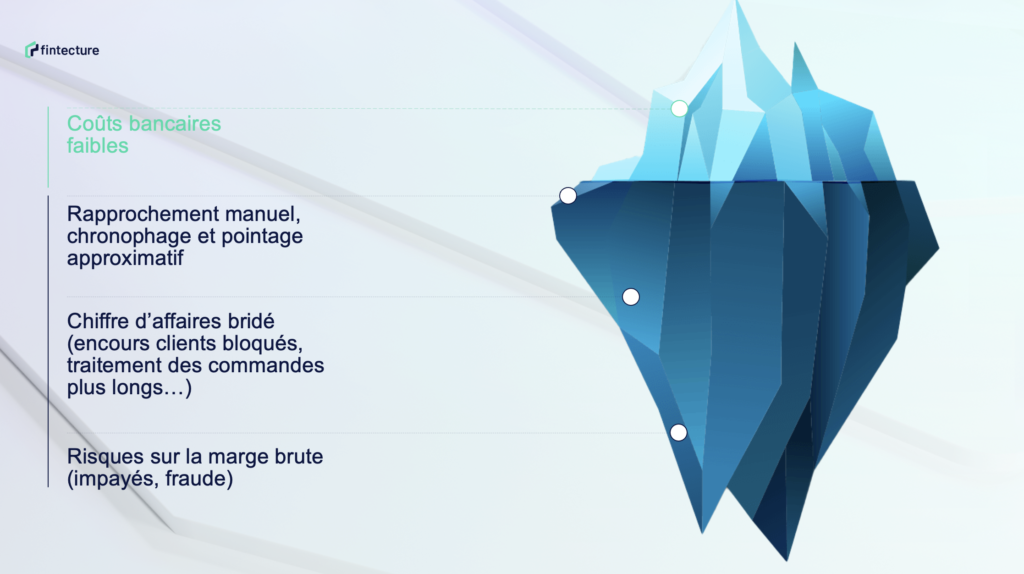

For many companies, the traditional bank transfer (or SEPA transfer) is perceived as a free payment solution: no commissions or fees are generally applied to transfers. But are they really cost neutral? Nothing is less certain.

While traditional bank transfers may seem free, processing them does generate hidden costs that are often overlooked or underestimated. What are their impacts on your profitability? What alternative solutions exist?

All the details in this dedicated article.

In 2020, in France, bank transfers represented 4,483 million transactions for a total of 32,713 billion euros.

This means of payment is particularly suitable for collecting high value payments. It is widely used in BtoB (90% of payments in value) and is also It is also proposed as an alternative to the check or the bank card in BtoC. Online, remotely or in store, it allows you to pay for large baskets which are often the source of payment failures due to bank card limits.

But the traditional bank transfer is not as free as it seems. It conceals many hidden costs, linked in particular to the human and manualrelated to the human and manual processing that it generates.

There are several steps involved in collecting a wire transfer. Each step may involve one or more people in different departments.

In order for your customers to pay you by bank transfer, you must provide them with your bank account number (RIB) which they must then register in their online bank. The addition of a new beneficiary is not instantaneousA validation period is often necessary. Depending on the bank, the operation can take up to 72 hours.

Once the client has made the transfer you should monitor your bank accounts to verify that you have received the payment. Some customers may send you a screenshot to confirm that the transfer order has gone through. However, since a standard bank transfer is revocable, it is safer to check yourself that you have been credited.

Once the transfer is received, you must find the corresponding order from the elements present in the detail of the operations: the date, the value and the reference of the transfer. If you are lucky, your customer will have specified the order reference in the object of the transfer. If not, identification can become a real headache. Indeed, these "mystery transfers" generate a lot of back and forth between the accounting department, the sales department and the customers. These time-consuming processes slow down the proper execution of the service. If there is a problem with the payment (error on the amount, delay...), the time spent is even more important!

Once the transfer has been identified, your accounting teams perform the reconciliations and modify the status of the order in your ERP or in the back-office of your site. Most of the time, this operation is manual and requires the use of different interfaces. Once these operations are completed, you can launch the preparation of the order (for a product) or allow your customer to access the service (for a service).

Ultimately, the processing of a traditional bank transfer is similar to that of a check. Despite the digitalization of the operation, it is accompanied by numerous manual tasks that are not without consequences for you and your teams:

A significant human cost

All of these treatments are costly in terms of human time. Have you already done the math? Estimate the time spent by your teams on each transfer (accounting, commercial, ADV...). Then multiply it by their salaries and by the number of bank transfers you process.

A risk of error

Manual processing means a risk of error. Errors can come from your customers, for example if they enter the wrong amount. You then have to follow up on them in case of incomplete or late payment. In case of overpayment, you will have to give them a credit note or offer them a refund. It is then up to you to get their bank account number and to proceed with the transfer!

A drop in productivity

Another underestimated point: the steps presented above interrupt your teams in their daily work and reduce their productivity. When broken down, they may take 2, 5, 10 or 15 minutes. But they interrupt your teams in their daily work. It is difficult to group them at the end of the day or once a week, because the processing of orders (and therefore the satisfaction of your customers) depends on your reactivity. Although it is difficult to estimate the cost of these "breaks", this element must nevertheless be part of your reflection on the impact of transfers in your organization.

Processing times impact your cash flow

Most bank transfer payments are not immediate. Collection delays increase your DSO (Days Sales Outstanding) and impact your cash flow needs. These cash management issues are not neutral, especially for companies that need a large amount of working capital. Financing your working capital is sometimes necessary and has a cost.

We invite you to read our article dedicated to this subject.

A degraded customer experience

When a customer wants to pay by bank transfer, they have to go through their online bank. Their purchasing experience is therefore interrupted. This interruption can have an impact on the sale, especially in the case of an online sale. A drop in the conversion rate has real impacts on your turnover and on your customer acquisition cost.

We can't say it enough: whatever your target or your activity, the customer experience is key! If you work in BtoB, don't neglect your buying paths. Indeed, 83% of B2B buyers prefer the online channel for their orders and 2/3 of them are disappointed by the online ordering experience (source: Fevad).

Locked-in receivables

If you work with a professional clientele, you probably offer outstanding amounts to your customers. They pay you in 30 or 60 days and usually pay by bank transfer. However, the time it takes to process their transfer (by the bank and then by your teams) prolongs their outstanding balance. The latter is only released once the funds are in your account. If, in the meantime, your customers reach the maximum amount of their outstanding balance, they will be blocked for their future orders. In addition to the impact on your WCR, you risk missing sales.

By setting up a Immediate Transfer solution, you enable your business customers to free up their outstanding balances more quickly , thereby encouraging repeat purchases.

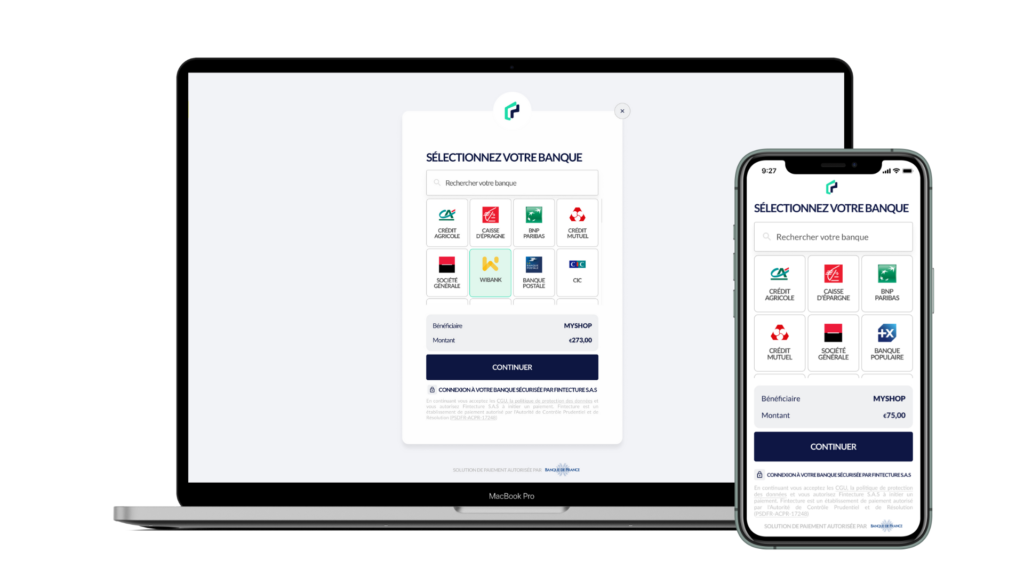

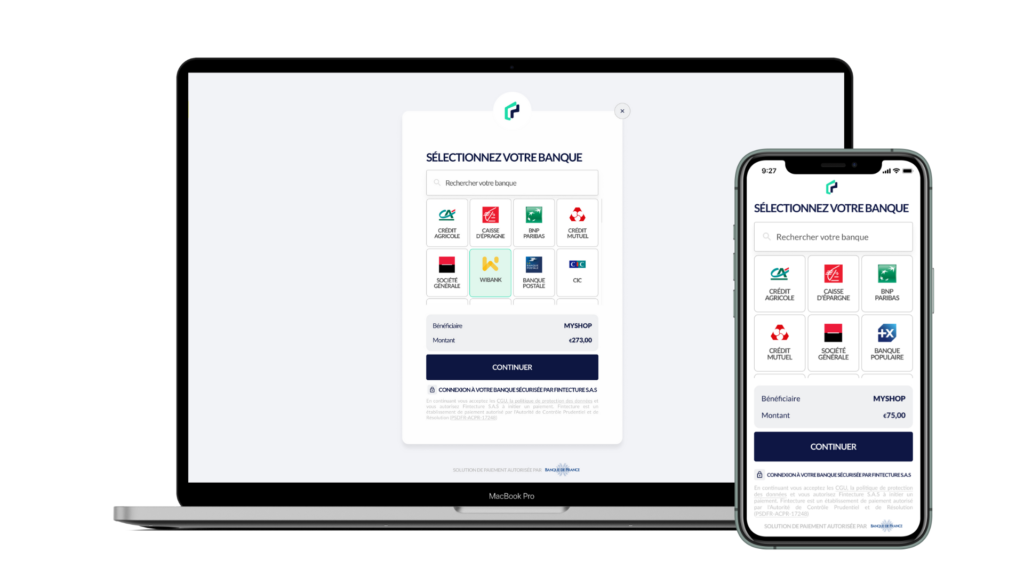

What alternative solutions exist to continue accepting payments by bank transfer? Fintecture has developed an online payment platform that replaces "traditional" bank transfers. Our solutions allow you to collect payments from account to account without the constraints of traditional bank transfers.

For this, we have developed 2 complementary payment methods:

Thanks to these solutions, you benefit from all the advantages of payment by transfer without the constraints.

A seamless payment experience for your customers

With the Fintecture immediate transferyour customers can pay by bank transfer in a simple and secure way. They no longer need to enter your IBAN, the amount and the order reference. Everything is pre-filled. The payment is done online via the Fintecture payment platform.

Real-time information on the status of each payment

You no longer need to go through your bank to find out if you've been paid.

Whether your customer pays by Immediate Transfer or Smart Transfer, you'll find the status and history of each payment in your Fintecture back-office. If you use a CMS, order status is updated automatically. Our solutions are also available in various ERP and invoicing software packages (Odoo, Libeo, Pennylane...)

Simplified reconciliation

Whatever type of transfer your customer chooses (Immediate Transfer or Smart Transfer), reconciliation takes place automatically and in real time.

For an immediate transfer, we use the order reference you send us (exactly the same as for a credit card payment).

For an intelligent bank transfer, we create a personalized IBAN for each of your customers. This VIBAN enables us to identify and track the payment. Coupled with our on-board intelligence, it automates reconciliation, detecting initial orders, overpayments or underpayments.

Reduced DSO

Thanks to Immediate Transferyou'll be credited faster than with a conventional bank transfer. This reduces your payment times (by an average of 3 days) and secures your cash flow.

A multi-channel payment solution

Fintecture is a payment solution that meets every need:

Ultimately, the choice of a payment solution should not be based solely on price. It is of course an element to take into account, but the reflection must be global. It must include other criteria such as customer experience, conversion rate and the impact of payment processing on your teams.

Driven by the PSD2, the account-to-account payment is becoming as essential as the bank card. The proof is in the pudding: some of Fintecture's customers have done away with the "classic" bank transfer and are now sending all their transfers via our platform.

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

AON x Fintecture partnership: working together to help companies secure their collections and protect their receivables.

The world of payments is changing! On June 28, 2023, the European Commission tabled a dozen texts...

We've put together a list of the best agencies for Magento e-shops. All of them are Magento 2 experts!