Payment initiation: How it works, benefits, and key questions

Master this payment method to boost your transactions: how it works, its advantages, and the essential questions to ask.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Every year, 56 billion euros of invoices remain unpaid according to the Coface, this corresponds to 2% of the French GDP. Unpaid invoices are the 1ʳᵉ cause of bankruptcy in France. Indeed, unpaid invoices generate holes in the cash flow of companies, generating difficulties for them to pay their debts to their own suppliers. For example, in 2020, 55% of companies did not respond to calls for tender for fear of not being paid on time. Also, according to Allianz, business failures in France could rebound by 15% in 2022 and 33% in 2023. With prices soaring and in the context of the war in Ukraine, it is therefore important to do what is necessary to get paid quickly.

With certain exceptions, article L.441-6 of the Commercial Code stipulates that a company has 30 days to pay its invoices from the date of receipt of the goods or the realization of the service. Here are the exceptions:

Making a reminder in case of unpaid invoices is not a compulsory act. On the other hand, to optimize your commercial relations, we recommend that you send a dunning letter or e-mail before directly putting your customer in default. Indeed, unpaid invoices are mainly due to oversights, accounting errors or losses. A reminder will thus prove your good faith and the will to find an amicable agreement in the first place.

Whether it is a letter or an email, the reminder has no legal no legal value. Thus, in the context of a lawsuit, you will not be able to take advantage of it.

To avoid unpaid bills, always remember the following:

An estimate must include a certain number of legal mentions, notably the services provided, to demonstrate your professionalism and protect you in case of litigation. It is essential to fill it in precisely and to note the amount of penalties foreseen in case of late payment. The customer is thus warned!

We recommend that you send a first reminder to the customer one week after the payment deadline. In general, it is not necessary to send a second reminder. The first reminder is sufficient, as most customers quickly realize the oversight or error and you will receive your payment within a week.

If your debtor has still not made the payment after this first reminder, you will have to consider one reminder letter or email per week. As reminders are not obligatory, there is no set number of reminders to be sent. Three reminders are however the norm and prove your desire to start a long-lasting commercial relationship, while allowing the customer to realize that he has not paid his debt.

Don't forget to send your reminder letters by registered mail or by e-mail with acknowledgement of receipt. This will be a useful proof in case of legal proceedings.

If, despite your reminder e-mails, your bill remains unpaid, you can invoke the legal authorities for a formal notice. A letter of formal notice is obligatory in order to bring a case before the courts and to explain in a clear and formal way what you are accusing the other party of. This letter asks the latter to fulfill his obligations within a defined period of time, under penalty of further proceedings.

If you have sold your receivables to a factoring company, the factoring company will carry out all the collection steps for you.

Subject: Invoice pending payment

Hello Mrs/Mr. [Name of person or position held],

Unless there is an error or omission on our part, I wanted to bring to your attention a few invoices that have come due for payment but have not yet been settled.

NO. | Invoice number | Amount | Expiry date |

|

|

|

|

Please also find the attached invoice.

To make the payment, click on the link indicated.

Should your payment reach us before receipt of this letter, please disregard it.

S’il s’agit d’une erreur, veuillez nous excuser et contacter le service clientèle au <numéro de contact> ou à l’email suivant <email de contact>.

Yours sincerely,

<Signature>

You can also access other examples of dunning here.

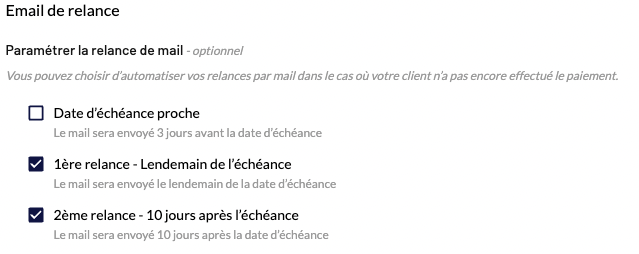

With Fintectureyou can automate your reminders. As shown below, choose whether you want to dun your customers 3 days before the due date, the next day, or 10 days later with a payment link.

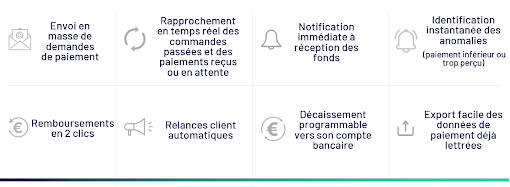

In addition, our management interface allows you to control all your transfers to avoid unpaid invoices:

Our piloting interface also allows you to to get paid faster:

Thanks to the control interface, you can finally synchronize your accounting data with those of your customers.

Fintecture lets you send payment links by e-mail, link, SMS, QR Code or in bulk to several customers at once. Users of Immediate Transfer users are redirected to their banking application, where all they have to do is validate their transaction quickly and securely! The Immediate Transfer is also irrevocable and l'payment authorization from the payer's bank immediateall without without any exchange of banking information.

To pay is very simple, the customer :

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

Master this payment method to boost your transactions: how it works, its advantages, and the essential questions to ask.

Learn how to reduce or eliminate check payments online and in-store with instant transfer.

This €26 million Series A round brings Fintecture's funding to a total of €32 million, following a €6 million round raised in May 2021.