Open Banking: a financial revolution ǀ Discover the benefits!

Discover Open Banking, a financial revolution! Secure data sharing and benefits for banking customers in France and Europe.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Bank reconciliation is an essential process for companies because it allows them to ensure that all their invoices have been paid, in order to know their cash flow level. The stakes are high when you consider that cash flow problems are the cause of 25% of SME bankruptcies. In France, only 58% of invoices are paid on time. We will see how the automation of bank reconciliation can become a performance lever for companies.

Although it does not involve a high level of complexity, bank reconciliation on Excel does generate a cost and an extremely time-consuming work because it requires many steps. Indeed, companies now deal with several bank accounts, both suppliers and customers. A bank account can contain hundreds or thousands of supplier and customer invoices. In these conditions, making thebank reconciliation statement takes an infinite amount of time for the accounting or financial teams, when they could be concentrating on other tasks.

In addition to the considerable amount of time required, manual bank reconciliation has other disadvantages:

Since manual bank reconciliation is the source of many constraints, it is in the best interest of companies and their teams to switch to automatic reconciliation!

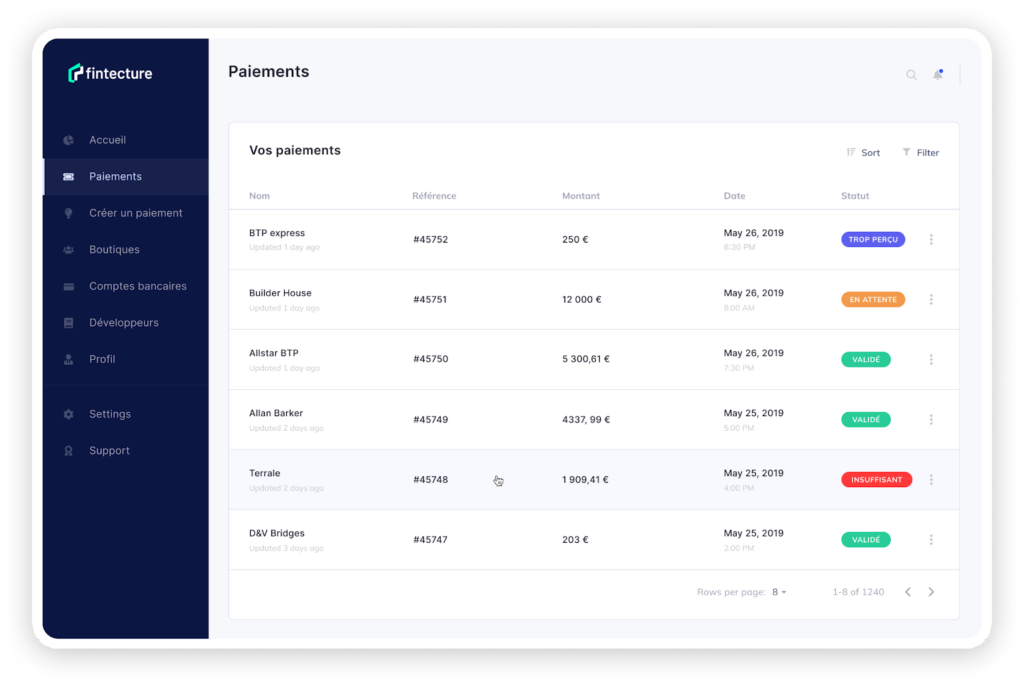

Fintecture has developed an innovative payment solution to automate bank reconciliation. The Virement Intelligent can be used by all corporate customers. A genuine alternative to the traditional bank transfer, the Intelligent Transfer integrates a personalized IBAN and a proprietary reconciliation algorithm for complete and instantaneous automation of bank transfer processing and follow-up, enabling improved financial management and better anticipation of working capital requirements (WCR) to preserve cash flow .

To make the automatic reconciliation process even smoother, we have created an interface dedicated to corporate cash receipts, which fits perfectly into an order to cash process. Thanks to it you can :

We note on the average use of our solutions by our customers :

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

Discover Open Banking, a financial revolution! Secure data sharing and benefits for banking customers in France and Europe.

One third of the companies that have been victims of fraud have suffered losses of more than 10,000 euros and 14% more than 100,000 euros. Fraud is thus a major issue for the financial stability of companies.

Free and convenient for customers, efficient and opportunity-generating for merchants, click & collect has it all!