A new payment method to increase your sales

Black Friday is the start of the year-end shopping season. During this crucial period for retailers, more and more French people are doing their shopping online.

Fintecture, the bank transfer payment solution

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

Immediate transfer

Mobile payment without terminal

by Link, Email, QR code, SMS

Raise funds efficiently

Give your business customers a deadline

Credit your customers easily

You have added the Immediate Transfer to your payment solutions (or are considering doing so)? Great news!

Your customers will be able to pay by bank transfer easily and seamlessly. As for you, say goodbye to lost sales due to exceeding your credit card limit. You'll improve your conversion rate and increase your average basket.

To get the most out of Fintecture's added value, we recommend that you support your customers and your teams in the use of our solutions.

Find all our tips and best practices in this article.

Payment is a daily act that touches two extremely sensitive and powerful notions: money and security. It is therefore normal that payment habits are slowly evolving. So, for your customers to adopt a new payment solution, they need to see the value in it.

It is therefore important to explain to them the advantages of choosing the Fintecture transfer. Indeed, this payment method is relatively recent. It is of course bound to develop massively and will eventually become a must.

This communication effort will bear fruit: customers who use the instant transfer Fintecture for the first time are now using the solution for their next purchases.

More than 7 out of 10 payments are made by payers who have already paid with Fintecture.

Regardless of the use case and sales channel, your customers will ask themselves 2 questions:

Here is a list of arguments that you can put forward depending on your activity and the profile of your customers:

This argument is primarily aimed at customers who prefer to pay by credit card. It is particularly impactful if your average basket is high. Indeed, 15 to 20% of payment attempts by credit card fail, mainly because of reaching the limits. The larger the basket, the higher the failure rate.

Highlight the advantages of paying by bank transfer: the limits are much higher than those of a bank card.

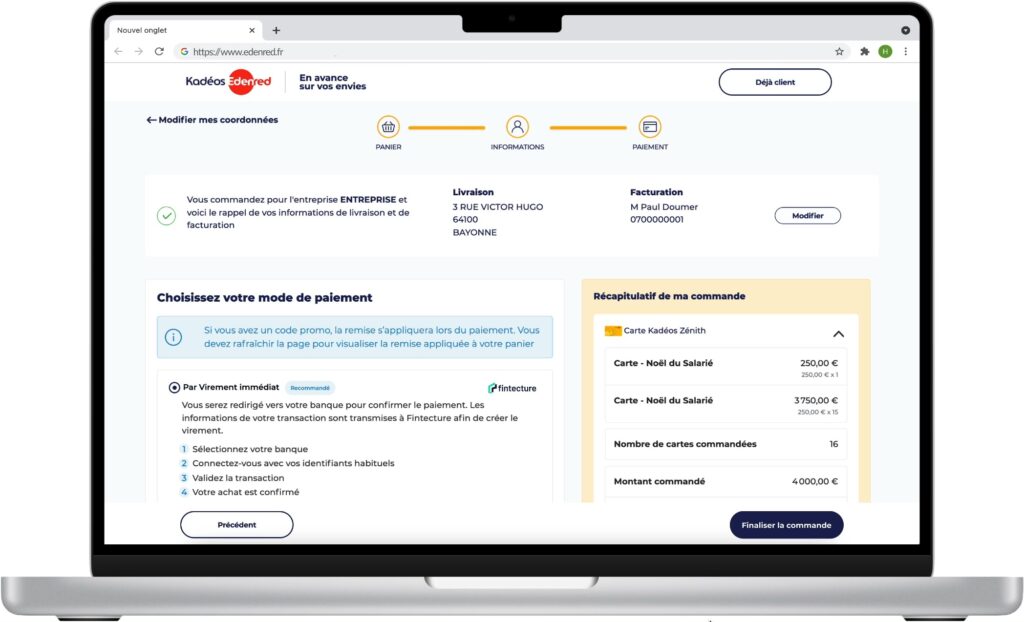

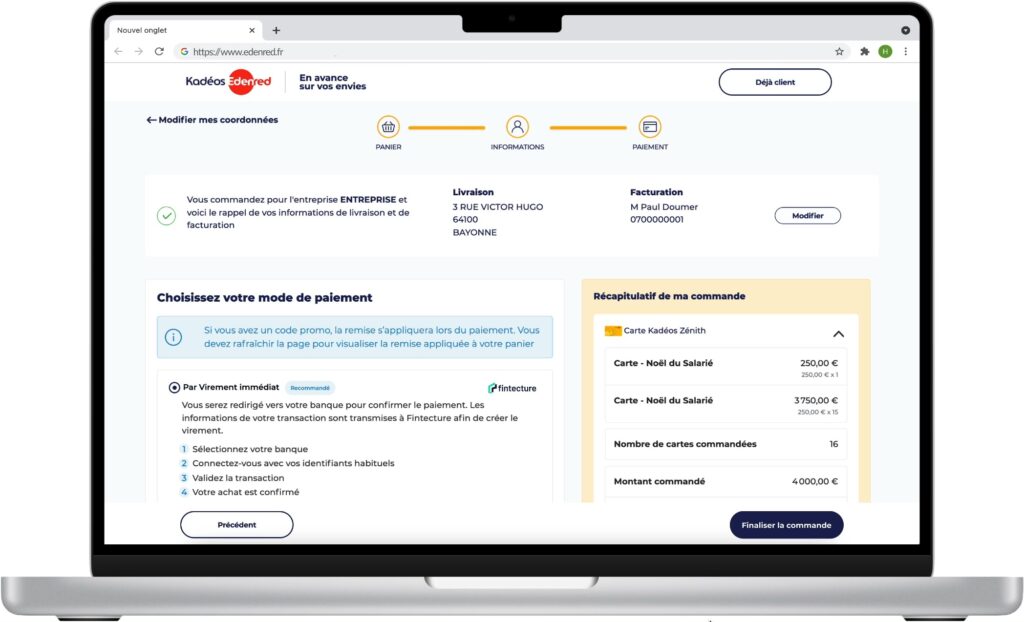

You can promote the instantaneous nature of the Immediate Transfer and its impact on customer relations and logistics. This argument is aimed at customers who are used to paying by SEPA transfer or check. These payment methods come with a processing time that blocks the validation of their order. By choosing the Immediate Transferyour customer will be served faster. You'll receive immediate payment confirmation, so you can confirm your customer's order without delay. If, like Bricoman or Edenred, you promise your customers delivery within 24 or 48 hours, this argument is essential.

In the collective imagination, credit transfers are associated with a manual, time-consuming and complex procedure. So it's vital to explain that the Immediate Transfer Fintecture Immediate Transfer is not like a traditional bank transfer. It's much simpler: your customers don't have to set up the transfer from their online bank. They go through our payment platform where everything is pre-filled: order amount, reference number, IBAN... Explain to them that by choosing this option, they benefit from all the advantages of a bank transfer, with a process as simple and secure as a credit card payment.

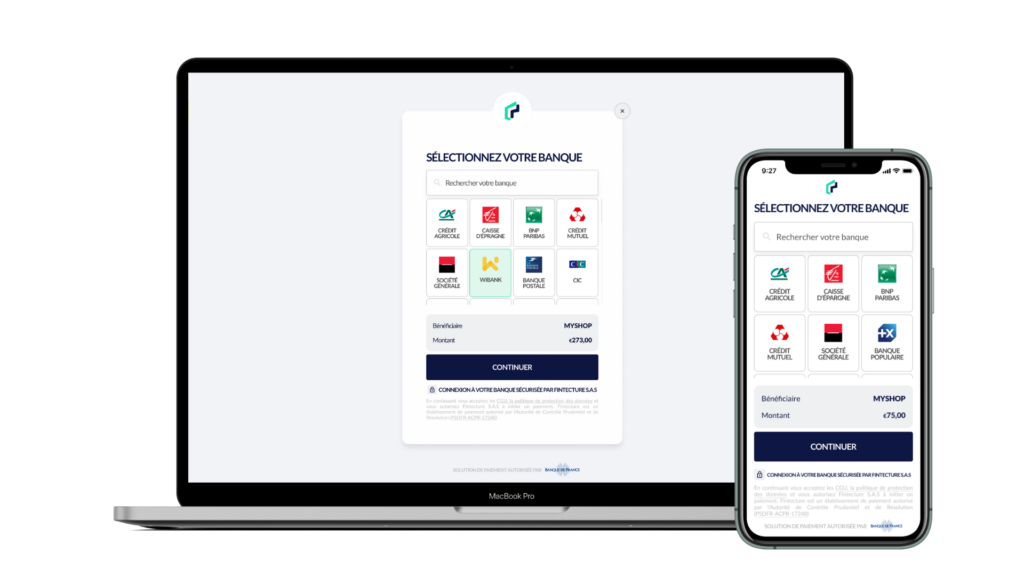

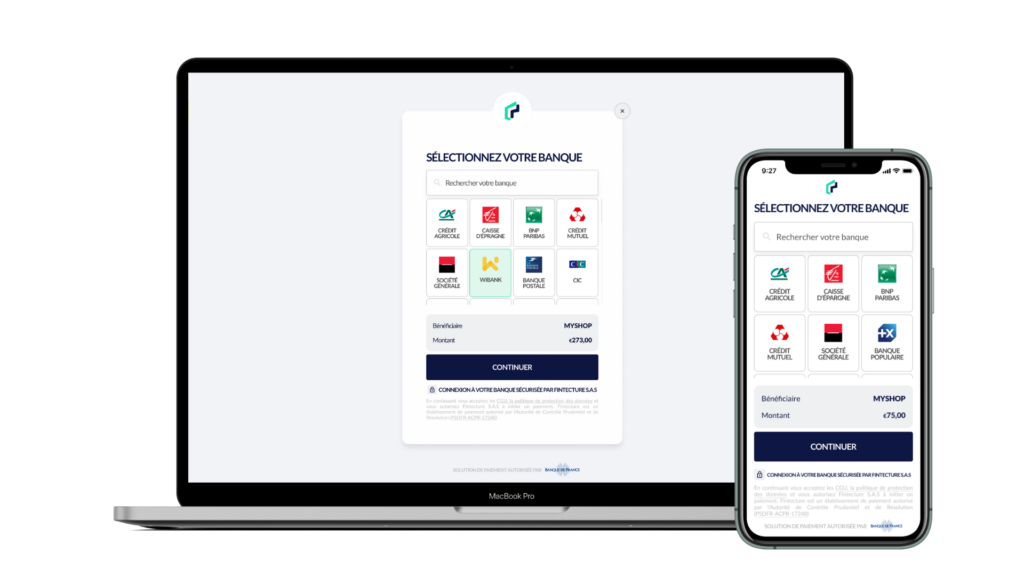

Once your customer is convinced, it is important to explain to them how their payment will work with Fintecture. The customer experience will likely be new to them. Here are a few things to emphasize:

Redirection to your bank space

Whatever the payment method (e-commerce, payment link, QR code...), your customer will have to select his bank and will be redirected to his secure banking space.

Entering his bank identifiers

He will then have to enter his banking identifiers (login and password). If he is on his mobile, this step is often simplified: he can identify himself by Touch ID (fingerprint) or Face ID (facial recognition).

On a desktop, the input is manual: he must know his login and password.

It's possible that some of your customers prefer to use a traditional bank transfer. This may be the case in BtoB, where the buyer doesn't always have access to his company's bank account. In this case, we recommend that youadd our Intelligent Transfer. For your customer, the payment experience will be similar to that of a conventional bank transfer. On your side, you benefit from simplified reconciliation and real-time payment tracking thanks to our personalized IBAN system. To activate this option, please contact Fintecture support.

We'd like to share with you a few best practices that have enabled our merchant partners to take advantage of the benefits of Immediate Transfer and increase Fintecture's ROI.

As a general rule, don't wait until the Payment stage to communicate about the Immediate Transfer. We recommend that you explain and promote Fintecture payment well in advance of order settlement:

You will find advice and elements to use (visuals, content...) in our communication kit.

On your website, set up your courses to offer payment by Fintecture in case of payment failure by credit card.

You can also restart your failed orders asynchronously and offline. To do this, generate payment links from the Fintecture console. You can insert them in an email dedicated to failed orders.

Some of your customers still ask to pay by check? Encourage them to switch to Fintecture transfers. This will allow you to save time on time-consuming tasks and reduce the risk of unpaid bills (read our article dedicated to checks). If your customers are reluctant, our teams have developed a practical sheet that you can send them. Ask our support teams for it.

We have just talked at length about the importance of communicating with your customers. It is also important to talk about Fintecture internally. Your teams will be the best ambassadors of the solution. We therefore invite you to introduce Fintecture to all your employees.

The way you present Fintecture on your payment choice page will have a big impact on the usage of the solution. Below are recommendations from merchants who are achieving the best ROI with Fintecture.

Position the Immediate Transfer high up on your payment options page.

Position Fintecture in the first or second position. If you can customize your page according to criteria, display Fintecture in the first position for high shopping carts.

Add the word "Recommended" next to the Fintecture immediate transfer.

Your customers will surely appreciate it.

Remove the classic bank transfer option

Combine the Immediate Transfert Fintecture and the traditional bank transfer can be confusing for your customers. If you want to keep this option open for your customers, we recommend that you activate Fintecture Smart Transfer. To do so, contact Fintecture support.

You have integrated the Checkout brick of Fintecture to your e-commerce site. Did you know that you can use Fintecture to collect payments on other sales channels?

From the Fintecture console, you can easily create payment requests in the form of a link, email, SMS or QR code. This functionality is included in your offer at no extra cost.

Several use cases are possible:

The Bricoman is a good example that perfectly illustrates the different possible uses of Immediate Transfer.

We hope these tips and examples will give you some ideas on how to make the most of the advantages of payment by Immediate Transfer.

It's up to you!

3200,00 €

READY TO CHANGE THE SYSTEM?

1799,99 €

The future of payment is here:

join the movement!

249,99 €

Black Friday is the start of the year-end shopping season. During this crucial period for retailers, more and more French people are doing their shopping online.

This €26 million Series A round brings Fintecture's funding to a total of €32 million, following a €6 million round raised in May 2021.

It is normal to find a lot of agencies offering their services, but which one should you trust for the creation or development of your e-commerce shop?

Europe's determination to move towards efficient payments is about to be demonstrated once again. The European Commission is speeding up the implementation of an ambitious program announced last June, timed to coincide with a tight electoral calendar (if possible before the European elections in 2024). It includes PSD3 and PSR (Payment Service Regulation). Technical access to payment infrastructures has been clarified. Instant transfers will, without too much suspense, be mandatory in Europe and free almost everywhere (all in a text of just ten pages!), with adoption by the end of the year.

The challenge will be to anchor the announced revolution in everyday life and achieve the expected volumes. So far, the reforms have not met all the ambitions, which are certainly high and therefore require time to adapt.